Italy is not only rich in history covering Antony and Cleopatra’s love exploits or Julius Ceasar’s tales. The boot-shaped country also boasts of rich innovation in the world of mergers and acquisitions. The innovation is not new because dating centuries back, there has been technological advancement ranging from traditional craftsmanship to modern tech startups.

The Italian market offers the world market a good blend of established companies and emerging industry disrupters. Being an experienced investor or budding business owner doesn’t matter, understanding the Italian M&A landscape is vital for exploring opportunities and avoiding errors.

Italy’s Economic Backbone: SMEs and M&A

Small and medium-scale enterprises (SMEs) — like in many parts of the developed world and third-world countries — form the backbone of Italy’s economic growth and development. According to the OECD Library, SMEs make up more than 99.99% of Italian businesses.

Another important development is that these businesses are continuously conducting mergers and acquisitions (M&A) as one effective strategy for economic growth. This also means that businesses get to explore new technologies and expand beyond Italy’s borders.

On another side, this also creates good opportunities for both internal and foreign businesses that are looking to join the army of SMEs in Italy.

Regulatory Environment: Facilitating M&A

M&A Investors in Italy are always reminded that the process — like in every other country — is governed by some legal and regulatory system. Recent changes introduced by the Italian government in a bid to improve efficiency and transparency in the M&A process.

This made it more attractive to investors, who in 2022 continued M&A deals at a pro-pandemic level, as confirmed by PracticeGuides. “In 2022, M&A activity slowed compared to 2021, but despite the difficulties and the externalities, it remained at pre-pandemic levels, confirming the attractiveness of the market even in hard times”, their article titled “Corporate M&A,” wrote.

With the current business economy in mind, it’s important that M&A regulations in Italy, including the legal framework, are rather a facilitator and not a hindrance to the growth of the M&A sector. The regulatory changes in Italy — everyone must be reminded — weren’t just limited to the M&A sector, as they affected other sectors such as electricity, gas, and fuel that equally affect Italian businesses, the majority of whom are SMEs.

Key Sectors and Foreign Investment

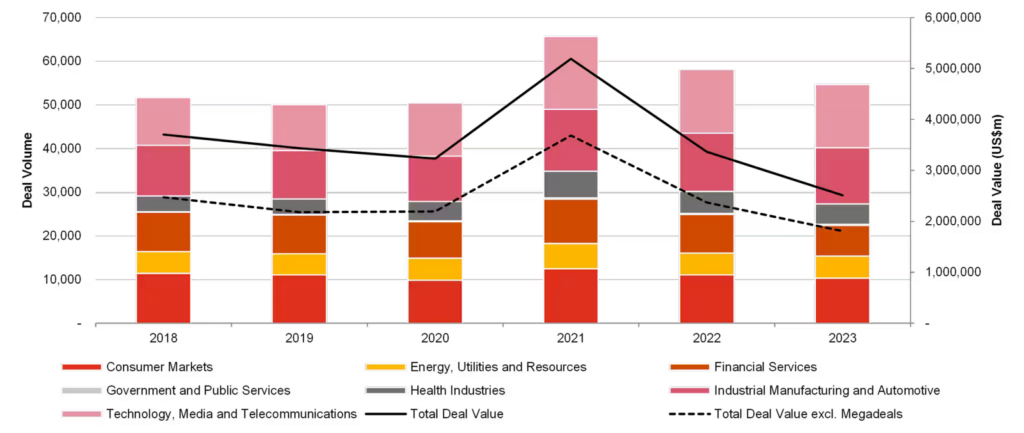

The European nation has many thriving sectors for M&A activities, with technology and its attendant innovation and transformation standing tall as the primary growth driver in the country.

A guess of the regular Italian market will get business-minded individuals and random investors saying the major market will be the luxury goods sector, with Italian craftsmanship being the main attraction of significant investment in that aspect. There are many other sectors, where M&A deals are currently making inroads, and they include the following sectors:

- Energy, Utilities, and Resources Financial Services

- Government and Public Services

- Health Industries

- Industrial Manufacturing and Automotive

- Technology, Media and Telecommunications

More international interest and the resultant foreign investment in Italy sheds light on the nation’s global appeal and its dynamic market — a spice for every adventurous businessman.

The M&A Process

Just like every intentional M&A, Italian businesses follow a clear process, in which due diligence is important with a clear priority also given to financial and legal matters.

Here are the stages of an M&A process in Italy:

- Letter of Intent (LOI): This is the starting phase of an M&A deal. It has the following features. It is non-binding but sets the baseline for negotiations. It should clearly outline key deal points like price, structure, and exclusivity. Italian law recognizes LOIs, but enforceability depends on specific factors.

- Due Diligence: As in every business deal, this is important and the parameters differ according to industry. This is what to watch out for during due diligence in different sectors:

- Commercial: Financial health, market position, running and finished contracts, intellectual property.

- Legal: Corporate structure, compliance with local and international laws, potential liabilities, existing and potential tax issues.

- Environmental: Potential contamination, waste management system, compliance with waste management regulations.

- Labour: Employee contracts, collective bargaining agreements, potential disputes, and resolution process.

- Tax: Tax liabilities, transfer pricing, and tax treatment of the transaction.

- Highly regulated industries: Seek professional advice where needed.

Due diligence or “asking questions” is vital to avoid legal and financial issues in the future after acquisition. This stage where delicate information about a business is unveiled, this stage is better done in a data room setup.

- Representations and Warranties (R&W): This is the time when a buyer is convinced to make a financial commitment to a business. Events include:

- Seller’s assurances about the accuracy and comprehensiveness of data provided.

- Buyer relies on R&W to assess risks and determine the right purchase price.

- Common R&W in Italy, which include:

- Title to assets

- Financial statements accuracy

- Compliance with laws

- Absence of undisclosed liabilities.

Note that the wording and scope of R&W are heavily negotiated, and influenced by deal structure and risk allocation.

R&W is a delicate stage of the M&A process and this can make or mar a running business deal.

- Settlement of Conditions and Covenants: More agreement follows at this level with more focus on legal downsides.

- Closing typically depends on fulfilling certain conditions (e.g., regulatory approvals).

- Covenants impose pre-closing restrictions on parties (e.g., non-solicitation.

At this point, legal counsel is needed to draft clear and enforceable clauses.

- Negotiations: After proper talks and review of all clauses and potential risks and benefits. This stage comes, and it includes:

- Focus on deal terms, price, R&W, conditions, and post-closing provisions.

It’s important to note that at this stage, cultural awareness and understanding of negotiation styles can be beneficial.

- Final Agreement: This stage comes before a business interaction can be referred to as an “M&A” deal. The process includes:

- Comprehensive document review of the final terms of the transaction.

- Complying with Italian corporate law and other relevant regulations.

- Careful drafting and review by a legal practitioner to ensure clarity and enforceability.

In this M&A process, most aspects including legal considerations should be done on a secure platform such as a virtual data room, which was recommended in this section for due diligence, during which documents will be shared.

Future M&A Trends

The Italian M&A sector is ready for further innovation, with digital transformation already underway in the deal-making process. With tech-driven solutions such as data rooms for M&A, remote collaboration is possible in the sector and expansion beyond borders is set to explode, especially after a bearish 2023 financial year.

Also, environmental, social, and governance (ESG) factors are gaining popularity, and they are currently influencing investor decisions and affecting transaction strategies for businesses.

Conclusion

The Italian economy and M&A sector is a spot for investors and growth-oriented businesses to camp and make the most of opportunities. The diverse sectors, unique tradition, as well as the positive regulatory environment such as the Italian government’s reduction of energy bills in 2022, have positioned Italy as a convenient destination for businesses seeking successful M&A deals and a profitable future. It’s important not to forget that a VDR can ease the due diligence process, enabling convenient document sharing for an ideal smooth business transaction.